Dorset Council Cabinet unanimously backs plans to double tax on second homes

By Trevor Bevins - Local Democracy Reporter 2nd Mar 2023

Dorset's 5,700 second homeowners are a step closer to having to pay double council tax on their properties.

Cabinet members of Dorset Council voted unanimously to adopt a policy to double council tax on second homes across the county, and to implement an empty home surcharge. The two measures are likely to bring in an extra £10million a year.

A final decision will be made at a full council meeting in March, where it is almost certain to be approved – although the legislation will also have to first be approved by parliament before the changes can be introduced.

Dorset Council is taking advantage of flexibilities in the government's Levelling Up and Regeneration Bill which, if it becomes law, will enable the introduction of a 100% council tax premium on second homes.

The Bill requires the council to make a decision a year in advance of introducing a premium on second homes, and so the earliest the change could be introduced is from April 2024.

In order for the premium to be implemented in 2024, the government's Levelling Up and Regeneration Bill must have received Royal Assent by April 1 2023.

Four of the Conservative-controlled Cabinet were unable to take part in Tuesday's debate and vote because they have second homes.

The meeting heard that there had been "considerable correspondence" from second home owners who have properties in Dorset, opposing the new tax levels, with many residents also writing to support the changes.

One second home owner, Graeme Neale, who has what he described as a "small property" in Swanage, in addition to his home in Harrow, told how he and his family spent more than 100 days a year in the resort, spending in local restaurants and shops and using the services of local builders.

He said he would prefer to live only in Dorset but family circumstances prevented it at the moment.

Dorchester councillor Les Fry told the Cabinet meeting that it was a privilege to have a second home when many people could not afford to buy, or even rent, a property in the county and said that it was only right that they pay more.

Cllr Sherry Jespersen told the meeting that while some second home owners took little part in community life there were others, including some in her North Dorset ward, where they were considered respected members of the community and did get involved.

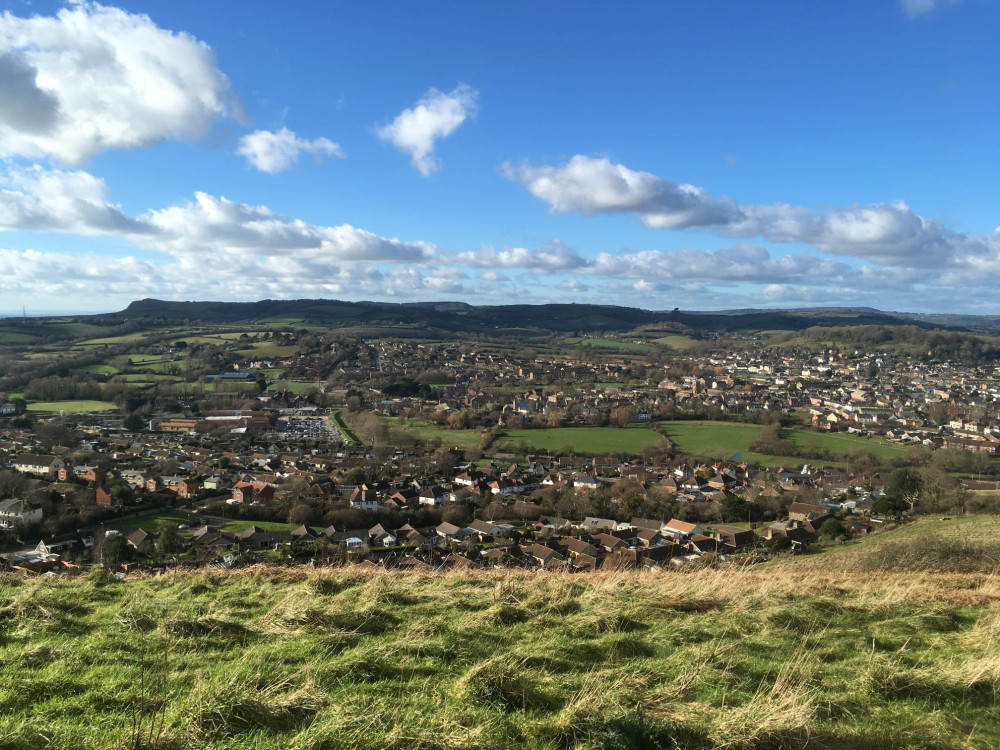

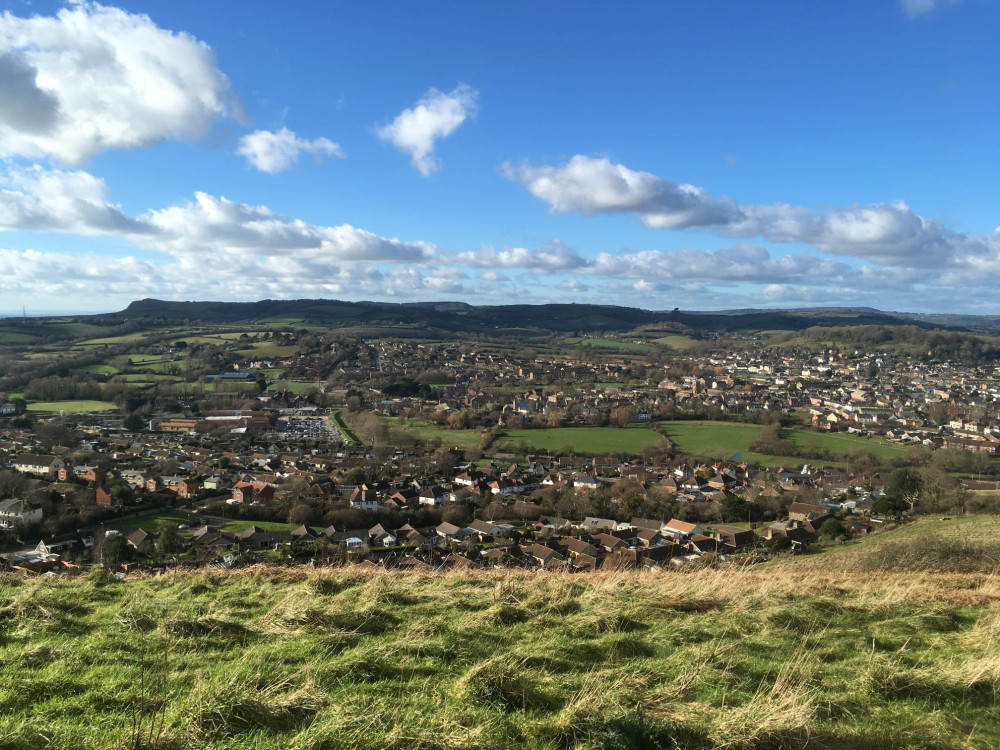

Deputy council leader, Cllr Peter Wharf, a Purbeck ward councillor, said there were now many areas in Dorset where working families found it increasingly difficult to access the housing market with the impact of second homes evident in many communities.

"This is not a penalty," he said.

"It's a privilege to have a second home and this will be a relatively small charge for that privilege."

He claimed that the extra income for the council could help to make a difference to the local housing market.

"This is a strong statement of intent to our residents, some of which are struggling to access housing," he added.

The meeting heard that the council has to adopt the policy by the end of March for the charges to apply 12 months later, bringing its April meeting forward to do so – although parliament will also have to approve the legislation and have it on the Statute Book for that to happen.

If there is any delay beyond the end of March the charges will not come into effect until 2025.

Weymouth councillor David Gray said he would like to see a defined percentage of the extra second home income earmarked for affordable housing projects in the county – a point which Cllr Wharf said would be considered in time for the end of March full council meeting.

West Parley councillor Andrew Parry said that, with the cost of delivering services in a rural areas being higher than in metropolitan boroughs, and Dorset Council getting lower levels of government funding than most areas, the council would be doing a disservice to residents now and in the future if it did not support the higher tax rates.

Even if approved, the changes will not affect holiday homes in the county which are mostly let out on a commercial basis and pay business rates rather than standard council tax.

A report to councillors acknowledges that some second homeowners might ask to convert their properties to commercial use, or find other legal ways to avoid the additional tax, but even if that happens the majority are thought to be likely to pay up.

CHECK OUT OUR Jobs Section HERE!

bridport vacancies updated hourly!

Click here to see more: bridport jobs

Share: