Dorset second homeowners could see council tax payments doubled

By Trevor Bevins - Local Democracy Reporter 17th Jan 2023

Dorset's 5,700 second homeowners could see their council tax payments double next year.

If approved, the increase could bring Dorset Council up to £9.5million in additional spending power per year.

Extra tax could also be levied on a wider number of empty and unfurnished homes – doubling the tax after one year, compared to the existing two-year start time.

The changes are being considered by the council's Cabinet next week (Monday, January 23), based on the government's proposed 'levelling up' legislation, which has yet to receive Royal Assent.

Even if approved, the changes will not affect holiday homes in the county, which are mostly let out on a commercial basis and pay business rates rather than standard council tax.

Provided the legislation becomes law and the proposal to raise the additional rates payable is backed by a full council meeting, the new charges would be introduced from April 2024.

Said a report to councillors: "The proposed changes to legislation to allow councils to apply a council tax premium on second and empty homes is primarily aimed at allowing councils to raise additional revenue and to acknowledge the impact that second and empty homes can have on some communities, with a view that especially in the case of empty properties this would incentivise property owners to bring those properties back into use at the earliest opportunity."

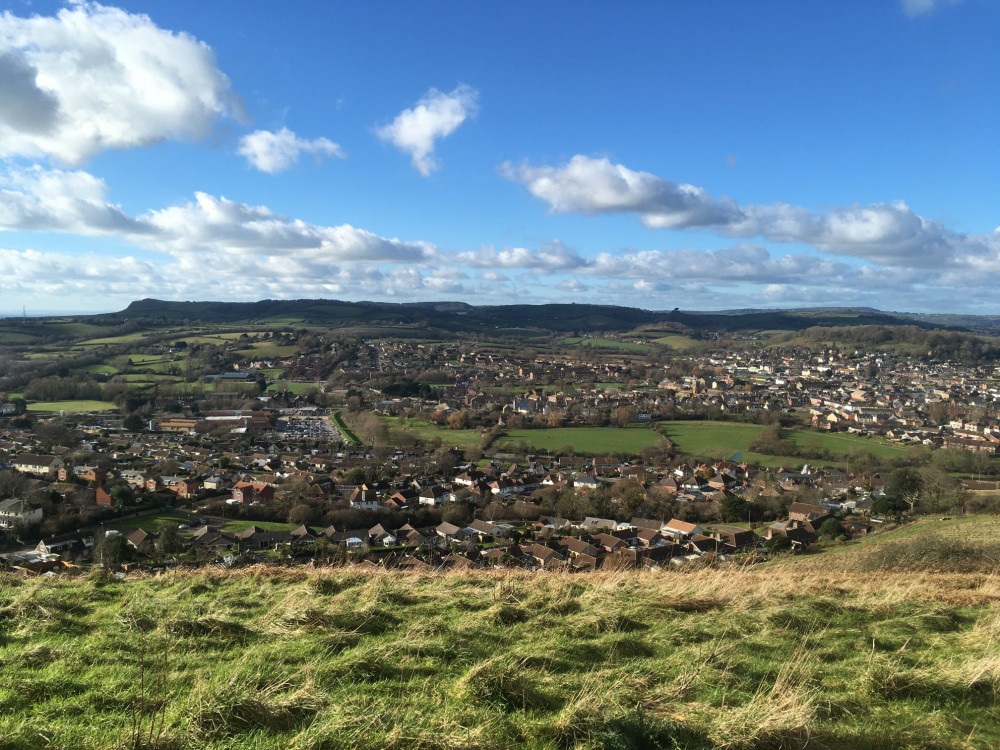

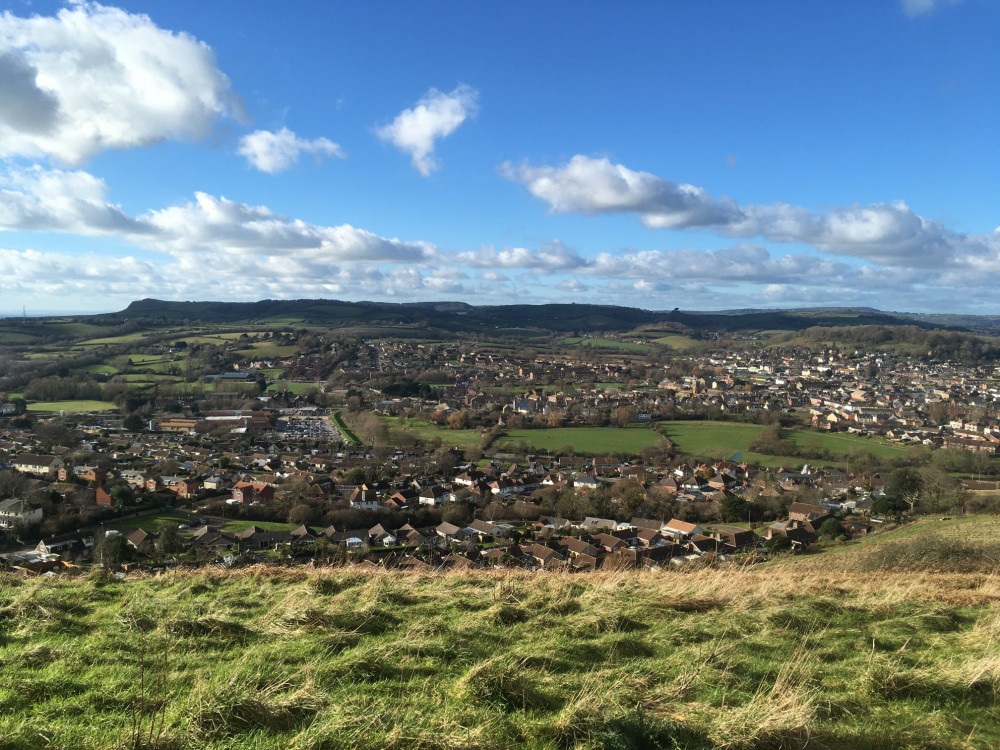

In some Dorset communities, especially 'picture postcard' locations, second and holiday homes often exceed 25% of all properties, leading, according to some, to a decline in a sense of community with rising prices forcing local people on average incomes out of the housing market.

The report to Cabinet acknowledges that, if the additional tax is levied, some home owners are likely to decide to sell or to convert their properties to other uses, but it says that even if that does happens there will still be the potential of £8 to £9.5m for the authority in additional revenue, compared to £10m if it applied to all of those properties known about at the end of November 2022.

Said the report: "There is a risk that the implementation of a second homes premium may encourage council tax 'avoidance' through people seeking to transfer their properties to business rates as holiday lets.

"This risk should be reduced with the government also bringing in a requirement for people to evidence to the Valuation Office Agency that alongside having their property available for let for at least 20 weeks in a year, it must also have been actually let for at least 70 days.

"It is the Valuation Office that make the decision if a property is entered and remains on the council tax list or the business rates list."

An extra £1.1m could come from levying the high tax rate on empty homes a year earlier, although officers believe that with "scope for reasonable challenge" on the decision the actual increase in revenue could fall to between £500,000 and £600,000.

CHECK OUT OUR Jobs Section HERE!

bridport vacancies updated hourly!

Click here to see more: bridport jobs

Share: