Second homeowners expected to fight doubling of council tax – if introduced by Dorset Council

By Trevor Bevins - Local Democracy Reporter 27th Feb 2023

Some second homeowners in Dorset are likely to do what they can to avoid a doubling of the council tax on their homes – should it be introduced.

Others have said they will sell up and not come back to the county again, according to councillors during a recent debate on the issue.

It has been recommended that Dorset Council take advantage of flexibilities in the government's Levelling Up and Regeneration Bill which, if it becomes law, will enable the introduction of a 100% council tax premium on second homes.

The Bill requires the council to make a decision a year in advance of introducing a premium on second homes, and so the earliest the change could be introduced is from April 2024.

In order for the premium to be implemented in 2024, the government's Levelling Up and Regeneration Bill must have received Royal Assent by April 1 2023.

Many second home owners have told Dorset councillors that they are not happy with the doubling of council tax, although Dorset Council could gain at extra £9.5million from the 5,700 second homes in the county.

Deputy council leader Cllr Peter Wharf said he doubts if the full amount will ever be collected, because many owners will employ lawyers and accountants to legally find ways of avoiding the doubling of the tax.

He also warned that, while the extra revenue might be welcomed by local council taxpayers and Dorset Council, it could lead to unexpected consequences which might not be so welcome.

He told the story of one community where it was relatively easy to find a retired judge but almost impossible to find a plumber, care worker or teacher.

Others had similar stories; Cllr Roland Tarr said he had spoken to residents where there was a high proportion of second homes, and shops and pubs had closed. One had told him that those who owned the second homes were not using village facilities.

Cllr Sherry Jespersen said that while there were second home owners in her Hillforts and Upper Tarrants ward who did contribute to local life, many did not.

She said that all the local statistics spoke of a housing gap – with 3,700 people on the Dorset housing register in need of a home and 2,000 waiting to be assessed.

She said there were currently 235 households in temporary accommodation and 92 in bed and breakfast, paid for by Dorset Council, with house prices in the county now at 11 times average local wages.

"To have a second home in Dorset when so many have none is a privilege… it's reasonable that we should ask people to pay a little more for that privilege," she said.

"We are not banning second homes and we are not telling people they can't have a second home, all we are asking is that they pay a little more for it."

Cllr Tony Alford said most local people supported the additional tax on second homes because they could see the impact second homes have on the vitality of local communities.

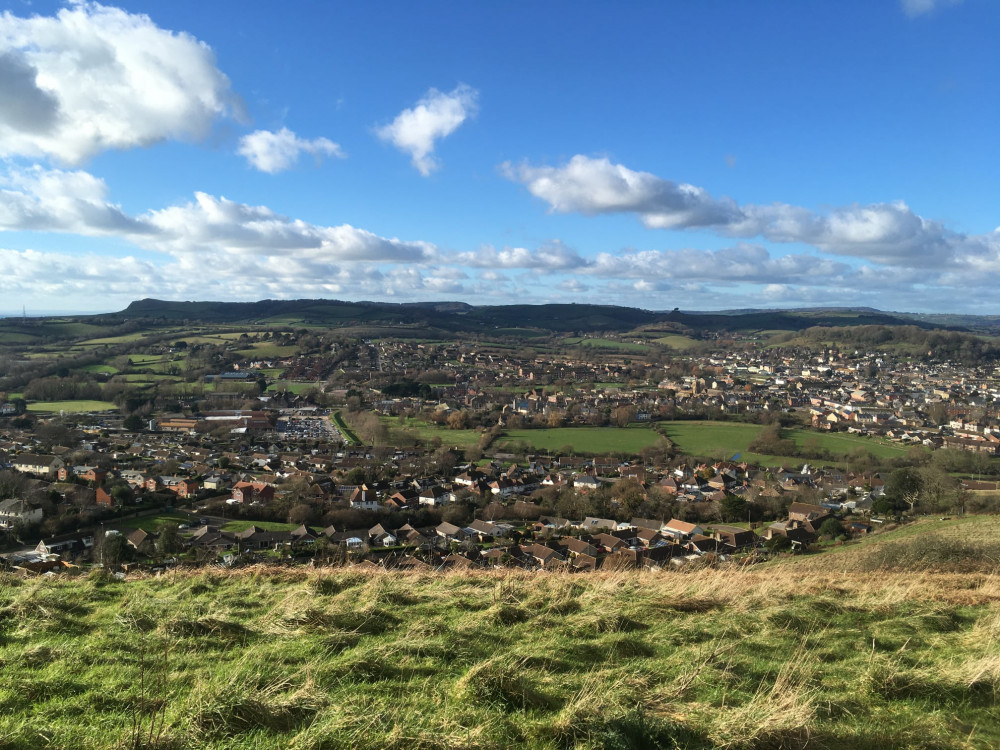

Cllr Val Pothecary, the council chairman, said she had villages in her area, around Gillingham, where 30% of the homes were second properties, putting pubs, shops and even schools at risk of becoming unsustainable.

"This is an opportunity to redress the balance a bit," she said.

Other supporters of adopting the doubling of council tax for second homes included Dorchester Cllr Les Fry, who claimed: "The occupants of these properties do very little to support our economy…and the extra revenue anticipated will be valuable as Dorset Council seeks to balance the books and support our communities."

A council report said that a further £1.1million could come from levying the higher tax rate on empty homes after one year, rather than two.

A final decision of whether or not to adopt the changes locally, should they be approved in time by the government, will first go to a Cabinet meeting on February 28 and then to a full council meeting at the end of March, which has been brought forward from April so the proposed introduction of the premium isn't delayed beyond 2024.

If the premium is to be implemented in 2024, the government's Levelling Up and Regeneration Bill must have received Royal Assent by April 1st, 2023.

CHECK OUT OUR Jobs Section HERE!

bridport vacancies updated hourly!

Click here to see more: bridport jobs

Share: